“Begin with the end in mind.” Sometimes “The End” is a scary thing to think about. Not always – the end of a bad situation or rough period of time can be something we look forward to. But often the simple uncertainty of something coming to a close is enough to cause...

INSIGHTS

Thoughts on strategy and operations from a Fractional COO

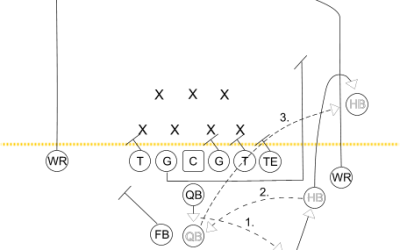

Lessons from sports

We learn a lot as kids that we forget or ignore when it comes to our jobs and businesses. Watching a youth baseball game this weekend, I saw a team of nine year old kids model how we can be better at work. What lessons from sports can we apply to running a business?...

Good growth

Growth is good – until it isn’t. If you grow too fast, you can damage your brand, compromise your product, and burn out your team. Good growth is managed and planned. Let’s look again at a lesson from recent history. Toyota has long been recognized for their...

Management and culture make a difference

If you don’t believe that management and culture make a difference in your company’s success, you are wrong. Let me give you an example from Toyota that I learned about from a recent podcast. When Toyota was making their first moves to manufacturing in the US, they...

Cash in the bank

Having cash in the bank doesn't mean your business is making money. I've worked with many business owners who closely manage their cash flow and bank account balances. That's great. I do the same thing both for my personal and business accounts. Unfortunately, some...

Culture Matters

I recently received an email from a new vendor telling me they were going to miss an appointment. I couldn't have been happier. Not the usual response, is it? The vendor was making a schedule change for all clients due to weather conditions. They informed me of the...

Owning versus Mastering Your Tools

There is a huge difference between possessing and being able to use tools effectively. One of my friends bought a new set of golf clubs. This is nothing new – he does that every couple of years. It prompted a mutual friend to sarcastically comment, “you have the best...

Fractional COOs and Swiss Army Knives

Fractional COOs are the Swiss Army knives of the fractional executive world. "Operations" means different things to everyone and each industry. Because every client has different needs, we must have lots of tools at our disposal. We also have to be flexible in scope...

Autonomy and Accountability

As a kid I learned about balance. I once made Kool-Aid without putting any sugar in it. Add the mix to water and stir. The results were not good. The reason is the ingredients weren’t in the proper proportion or were missing altogether. Companies without balance...

Act now

The hill was more than I bargained for. It was a struggle and I should have realized earlier that is was time to act now. I had all kinds of excuses: the weather was bad. I didn’t have time. It could wait another day. I had other plans. No, I wasn’t hiking up a...

Facing change

Sometimes you initiate change, and sometimes it is forced on you. Regardless of how you got there, you must deal with it. Facing change isn't always easy or wanted. Key employees leave. New technology disrupts the market. Your exit strategy or timeline changes. ...

You don’t have all the answers

It’s lonely at the top. We’ve created a myth of the confident CEO or business owner who has all the answers. Deep down, you know you don't have all the answers. The truth: no one does. CEOs of larger businesses may have a proven executive team who can act as a...

Turn ideas into reality

Business owners can be idea machines. Your business started as an idea, and ideas keep the business fresh and relevant. By themselves don’t accomplish anything unless you turn ideas into reality. Unless you can accomplish something by the stroke of a pen, you have...

A master class in customer service

Recently, I had two very different experiences with customer service that proved to be a master class in how to deal with customers. Both situations concerned lost packages, and I spoke with the shipper rather than the company selling the product. The difference was...

Does location still matter?

Location, location, location. That has been the mantra of real estate for years. Many employers, especially smaller businesses, also counted on location as a selling point. Unless you were willing to move, people typically looked for jobs locally. Location may...

Do you feel stuck?

Do you feel stuck? On one hand, you've been "all in" on building your business for a long time. You need time to do those things that only you can do, or you need to devote time to family or passions outside the business. You can't continue to do it all. On the other...

What season are you in?

“To everything there is a season…” The writer of Ecclesiastes first recorded this timeless truth which was later popularized in music by The Byrds in the Pete Seeger song Turn! Turn! Turn! The words remind us that the world is in constant change and that seasons come...

A Time to Plan and a Time to Act

2020 didn’t turn out like you planned. If this year were a road trip, you would have encountered detours, closed roads, and perhaps a few unexpected scenic overlooks along the way. You may or may not have ended up at your destination. Does that mean that planning...

Learning about business from sports

On a Saturday morning walk, I witnessed something so common we ignore the lessons it teaches – a tennis match. On the face of it, it was nothing extraordinary. Three matches, three courts, and twelve players. No umpire, no coach, no scoreboard, and no announcer. ...

What were you made to do?

Each one of us is wonderfully and uniquely made. We were made for something purposeful. Are you doing what you were made to do? This question applies equally to your personal life and your work life. No one else has the same mix of gifts, skills, education,...

You Need a Plan

Years ago I was helping someone cut down two trees from a clump of trees in their backyard. The first one fell exactly where we wanted. As we started on the second one, it started leaning in the wrong direction, pointed right at their house. We stopped so we could...

High-Performing Teams Require Trust

Do you trust your employees? A better question is whether they trust you. High-performing teams require trust at all levels of the organization. A lack of trust limits innovation and collaboration. It keeps good ideas, good processes, and good people from becoming...

What’s holding you back?

An employee of one of my clients wanted to talk to me about a project he was assigned. He had made no progress on it for over 90 days. Something was holding him back. He opened the conversation by saying “I don’t think I can do this.” I began asking questions....

Driving blind

No sane personal turns off their headlines and attempts to drive down a road at night. Cars have headlights for a reason: to illuminate what’s ahead and help you get where you are going. Mirrors and gauges serve similar purposes. Businesses are no different. You...

Small Business Benefits from a Fractional COO

Have you ever found yourself with thoughts like “my revenues are up but I don’t feel like I’m getting ahead” or “I need someone to run this project”? Situations like these are examples of how COOs can help small businesses and start-ups, but many owners and founders...

A failure of leadership

“What took you so long?” It was the worst feedback I ever received in my career. And it came from someone I managed, not my manager. I had failed to act. I failed to lead. I didn’t make the tough decision. I thought I was being nice. I thought I was getting...

Do you need a fractional COO?

As a business owner, have you wished you had someone to help you execute your vision? Or someone to focus on day-to-day operations? Perhaps you need a trusted advisor to discuss issues of strategy and execution? It may be time to consider hiring a fractional COO....

A Kayaker’s View of Strategy and Tactics

I was not moving, stuck against a rock and fighting the current. It took all the effort I had to make progress. My choices were to figure out a new approach to moving my kayak or getting out and admitting defeat. I finally leveraged my way into open water. In that...

Organizational Clarity is Critical

A lack of organizational clarity may be the root of many of the issues you face. Without organizational clarity, you have no accountability. Team members don’t know what is expected. They don’t know how their performance will be judged. They don’t know what the...

What’s your company’s DNA?

In our bodies, our DNA is the genetic code that makes us unique individuals. It contains all the instructions needed to build a complex, living, breathing organism. DNA is the master of each cell and is passed on through successive generations. Our DNA determines...

It’s time to change – Your Business 2.0

The Brady Bunch sang "when it's time to change, then it's time to change, from who you are into what you're gonna be." How is your business going to change AFTER the COVID-19 crisis and things begin to look a little more normal? You've been forced to learn, adapt, and...

The 4 C’s of Accountability

Do you wish you had more accountability in your organization? Business owners commonly express the need for more accountability when talking about their challenges. I have found leaders actually mistake other issues for a lack of accountability. Leaders build...

What is Operations anyway?

Lee Iacocca said “in the end, all business operations can be reduced to three words: people, product, and profits.” If you asked someone to define “operations”, what answers would you get? Probably statements ranging from “processes” to “getting stuff done” or “I’m...

Don’t be afraid of accountability

It is not unusual for business owners to tell me they want more accountability in their organizations. My first question for them is usually something like “what’s keeping you from holding people accountable?” I know it is easier said than done. Driving...

Creating Clarity

It's true - inquiring minds do want to know, if you are talking about the people who make your business run every day. They crave clarity. I was reminded of this working with a client recently on some operational challenges. The client, who uses EOS, said during our...

Lessons from a reality show

I’ll admit I’m a fan of survival reality shows like Survivorman and Naked and Afraid. These shows are entertaining to watch and you can learn lessons from reality shows too. I find The History Channel’s Alone to be one of the more engaging ones. The contestants...

Ending a professional relationship

Parting ways with an employee is one of the most difficult endings a leader must face. We deal with ending a professional relationship today in our third post on “The End”. Every employee is going to leave the business at some point. We may not like it but...

What’s Next

Eventually, you are going to retire. You may sell or exit your business. That’s great! What’s next? If you don’t have an answer to that question, then read on for the second part of our series on The End. While this post will focus on selling your...

Ready to take your first step towards breaking through to a new level of performance?

Then let’s hop on a call and see if System & Soul is right for you.