Eventually, you are going to retire. You may sell or exit your business. That’s great! What’s next?

If you don’t have an answer to that question, then read on for the second part of our series on The End.

While this post will focus on selling your business, it applies to someone retiring as well. This is a milestone many people look forward to with excitement. There are two very important questions you must answer:

- How will this transition take place?

- What will I do next?

Let’s start with the second question.

If you’ve been busy at work with a thousand things to do every day, what happens when that suddenly stops? How will you fill your time?

This abrupt change may leave you lost. Yes, you can enjoy your hobbies, sports, and travel, but you may feel you’ve lost part of who you are. Much of our identity is wrapped up in our work during our career.

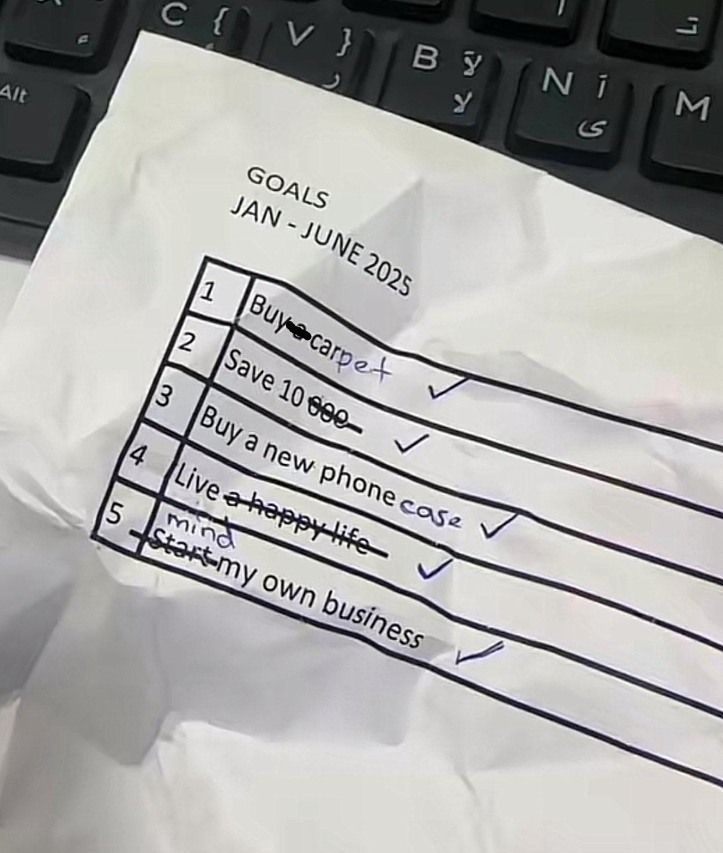

In this next stage of life, you still need purpose. You still have value to give. Whether you dedicate yourself to growing prize-winning roses, going on mission trips, spending time with family, or volunteering with a local charity, investing your time and energy into something or someone is an important part of our lives. Make sure you have a plan for your next stage of life before you step into it.

Now for the first question – how?

If you are exiting your business, you have a lot to think about:

- Will I sell it, wind it down, or hand it over to the next generation?

- How dependent on me is the business?

- What is the business worth?

The process to sell a business starts long before you actually make the transaction. You may need to clean up your books, delegate your responsibilities to others, and hire or elevate new leaders. You want to maximize the value of the business.

These steps take place several years before you actually sell the business.

If you have partners, it starts even earlier. Ideally, it starts BEFORE you start the business. Your operating agreement should outline how a partner exits the business and the rights and processes for all parties. Thinking about your exit when you establish your business can help protect and maintain your personal and professional relationships.

Think of retirement or selling your business as a transition and not just a destination so you can set yourself up to enjoy the next stage of life. Plan for it with the end in mind.

Opal Partners helps business owners prepare for exiting their business and preparing for what’s next. Reach out to us at https://www.linkedin.com/in/cmatt/ or CONTACT US.